What metrics confirm Indie Spotlight truly boosts game sales and player discoverability?

In the crowded digital marketplace, independent game developers face an uphill battle for visibility. Programs like “Indie Spotlight” are designed to cut through the noise, offering a crucial platform for emerging titles. But beyond anecdotal success stories, how can developers and platform holders definitively measure whether these initiatives translate into tangible boosts in game sales and significantly improve player discoverability? This article delves into the critical metrics and analytical approaches required to validate the effectiveness of such spotlight campaigns.

Quantifying the Sales Impact

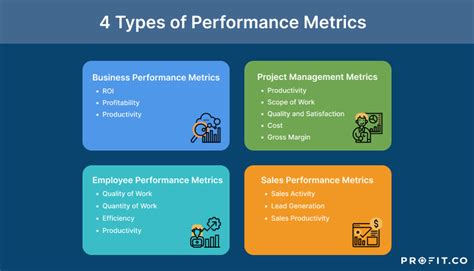

The most direct measure of an Indie Spotlight’s success is its effect on sales. Developers need to meticulously track units sold and revenue generated before, during, and after the spotlight period. A clear pre-campaign baseline is essential to demonstrate a true uplift. Key metrics include:

- Units Sold & Revenue: Direct comparison of sales figures for a defined period before the spotlight versus an equivalent period during and immediately after. This provides a raw, undeniable indication of commercial success.

- Sales Velocity: Monitoring the rate at which copies are sold. A significant spike in daily or weekly sales velocity during the spotlight suggests effective exposure.

- Return on Investment (ROI): If there’s any cost associated with the spotlight (e.g., promotional assets, platform fees), comparing this against the incremental revenue generated directly attributable to the campaign.

- Conversion Rates: Analyzing the percentage of unique store page visitors who ultimately purchase the game. An increase in this rate during the spotlight indicates that the exposure is reaching an audience genuinely interested in buying.

Measuring Enhanced Player Discoverability

Beyond direct sales, a primary goal of any spotlight is to increase the game’s visibility and reach new audiences. Discoverability metrics help ascertain if the game is being seen by more potential players.

- Store Page Impressions & Views: A fundamental indicator is the total number of times the game’s store page is displayed (impressions) and subsequently visited (views). A significant surge here confirms increased visibility.

- Wishlist Additions: Players often add games to their wishlist for future purchase. A substantial increase in wishlist adds during and after a spotlight indicates strong interest and intent, even if not immediately converting to a sale.

- Traffic Sources: Analytical tools often show where store page traffic originates. A clear attribution of traffic directly from the “Indie Spotlight” section of a platform provides irrefutable evidence of its discoverability impact.

- Media & Influencer Mentions: Track mentions across gaming news sites, YouTube, Twitch, and social media. A spotlight can often catalyze broader media attention, leading to organic discoverability through third-party endorsements.

- Community Engagement: Look at forum activity, social media shares, likes, comments, and follower growth. Increased engagement suggests a growing, interested community discovering the game.

Indirect Indicators and Long-Term Impact

While direct sales and discoverability metrics are paramount, several indirect indicators can further confirm a spotlight’s success and hint at long-term benefits.

- Player Reviews and Ratings: An increase in the volume of legitimate player reviews and ratings, especially positive ones, signifies a growing player base and validates the game’s quality to new potential buyers.

- Average Session Duration & Retention Rates: For games with longer playtimes, an increase in these metrics among new players acquired during the spotlight indicates that the spotlight successfully connected the game with its target audience, leading to sustained engagement.

Analytical Approaches for Attribution

Attributing success accurately requires a methodical approach. Developers should:

- Establish Baselines: Collect at least 4-6 weeks of pre-spotlight data for all relevant metrics to create a reliable baseline for comparison.

- Segment Data: Where possible, segment player data to identify players who discovered the game through the spotlight versus other channels.

- A/B Testing (if applicable): While difficult for a single spotlight, A/B testing different spotlight creatives or landing pages can offer insights into what resonates most with players, if the platform allows for such experimentation.

- Post-Mortem Analysis: Conduct a thorough review immediately after the spotlight concludes and again several weeks later to understand both short-term spikes and sustained impact.

Conclusion

For an “Indie Spotlight” initiative to be truly effective, its impact must be measurable and verifiable. By focusing on a comprehensive suite of metrics—from direct sales figures and conversion rates to wishlist additions, traffic sources, and community engagement—developers and platforms can move beyond qualitative assessments to quantitative proof. This data-driven approach not only confirms the value of such programs but also provides invaluable insights for optimizing future discoverability efforts, ultimately empowering more independent games to find their audience and achieve commercial success.